Dear Member,

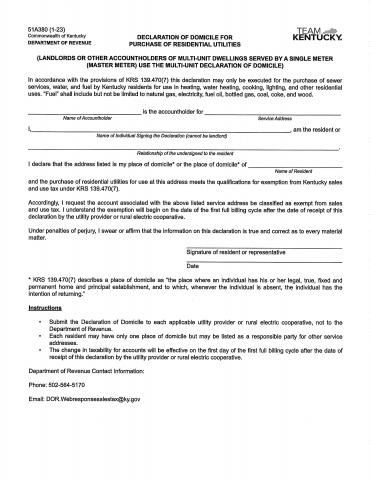

In the 2022 legislative session, Kentucky lawmakers enacted a change to sales tax laws that changes the treatment of utilities provided to Kentucky residents. Beginning January 1, 2023, only a person’s domicile or primary residence will be exempt from sales tax on utility services, including electric bills.

The new law states that place of domicile means the place where an individual has his or her legal, true, fixed, and permanent home and principal establishment, and to which, whenever the individual is absent, the individual has the intention of returning.

A declaration of domicile tells your utility companies that the address at which you are receiving service is your domicile and therefore should be exempt from sales tax. The Kentucky Department of Revenue prohibits a landlord from completing a declaration on behalf of a tenant. If you are a landlord receiving this request, please provide the declaration form to your tenant to complete and return.

Failure to complete and return the attached declaration of domicile by January 1, 2023, will result in the loss of a sales tax exemption as required by Kentucky law. Please be aware the Kentucky Department of Revenue has indicated they will not refund any sales tax for periods between January 1, 2023, and the date a declaration of domicile is provided to Shelby Energy and goes into effect.

If you have any questions about the new law or the declaration of domicile, please contact us at members@shelbyenergy.com.

Sincerely,

Shelby Energy Cooperative

Dear Member,

In the 2022 legislative session, Kentucky lawmakers enacted a change to sales tax laws that changes the treatment of utilities provided to Kentucky residents. Beginning January 1, 2023, only a person’s domicile or primary residence will be exempt from sales tax on utility services, including electric bills.

The new law states that place of domicile means the place where an individual has his or her legal, true, fixed, and permanent home and principal establishment, and to which, whenever the individual is absent, the individual has the intention of returning.

A declaration of domicile tells your utility companies that the address at which you are receiving service is your domicile and therefore should be exempt from sales tax. The Kentucky Department of Revenue prohibits a landlord from completing a declaration on behalf of a tenant. If you are a landlord receiving this request, please provide the declaration form to your tenant to complete and return.

Failure to complete and return the attached declaration of domicile by January 1, 2023, will result in the loss of a sales tax exemption as required by Kentucky law. Please be aware the Kentucky Department of Revenue has indicated they will not refund any sales tax for periods between January 1, 2023, and the date a declaration of domicile is provided to Shelby Energy and goes into effect.

If you have any questions about the new law or the declaration of domicile, please contact us at members@shelbyenergy.com.

Sincerely,

Shelby Energy Cooperative